How to Start Investing in Art

If you want an investment advice, people usually tell you to invest in stocks, real estate, or other fixed deposit schemes. Very few talk about art whereas collecting art is one of the most unique and enjoyable investments.

At present, art is as hot an investment as real estate due to the vibrant art scene and increasing profile of Indian art in the international market. The returns are as good if not better, provided one invests in the right artists at the right price. It is much easier to invest in art, one can invest in small or big amounts suiting one's investible surplus. Good aesthetics and some business sense - that is all that takes to make a smart investment in art. You can start at as low as Rs. 25,000 and go up to any amount that suits you.

To start, one should invest in large works of younger artists or buy drawings or small works of established artists that suit small budgets. Here are some investment options for a new investor in art at different levels up to Rs. 2 lakhs:

Rs. 25,000 to Rs. 50,000 - buy a work of Purvai Rai, Suraj Kumar Kashi, Tapas Maity, Mohan Malviya, Apurva Desai.

Rs. 50,000 to Rs. 100,000 - buy a work of Suman Chandra, Kirti Chandok, Padmanaban T., Somenath Maity, T.M. Aziz

Rs. 100,000 to Rs. 200,000 - Harshvardhana, Chandra Bhattacharya, Akhitam Narayanan, Manisha Ghera Baswani, Anjaneyulu G.

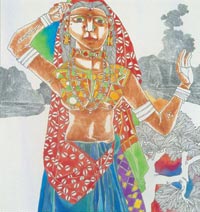

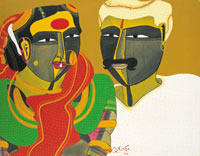

If one wants to invest in big names, drawings of Anjolie Ela Menon, Laxma Goud, Thota Vaikuntam, Yusuf Arakkal , Lallu Prasad Shaw, Sakti Burman, Shuvaprasanna etc. are the best options.

Buying works of young talented artists is the best way to get good long-term returns. Look for an artist who is represented by a good gallery, has got good reviews, has registered good sales in his first few shows. For short-term returns go for the works of the established artists which will fetch you a 100% increase in two to three years time frame. Make sure that the work appeals to you. So that even if the price remains static, you have a work which you'll enjoy.

Always keep abreast of the trends of the art market. Go through articles on art in newspapers and magazines, surf sites of good galleries, and auction houses. The auction results are good indications of the price trends and indicative of good investment bets for the future. Visit art shows, art galleries, interact with artists art critics and gallerists and keep a watch on how the artists whose works you have invested in are performing, which exhibitions they are participating. If they continue to make good works and are shown in good exhibitions, your investment value is bound to increase. Since the art world is not regulated as equities, the investor has to be cautious in buying and beware of unknown antique/art dealers, prices temporarily inflated by hype or in auctions and fakes floating in the market.

One should buy the works from a good gallery or from the artist directly and insist on an authenticity certificate. It would be difficult to sell the work in absence of its provenance. If one keeps the above few points in mind, one has to be very unlucky to lose money in art. There is only one way your investment will move. Upwards, besides providing you a lifetime of visual delight.

Investment in art is not only people with high-networth. Nowadays, I come across middle-level salaried people buying art. I know of a couple, who pay by post-dated cheques and take delivery of the work after the full payment is made. In the last few years, they have made a sizeable portfolio of investments.

The profile of the art buyer is changing over the years. Earlier investors were rich industrialists, corporate houses, and institutions. Now apart from the NRIs, one comes across many young buyers from the middle-class are showing interest in buying art. From the earlier refrain, 'we do not understand modern art' to the new generation of art afficinados, the profile of the art buyer is changing and art buying is becoming more broad-based. Is it something to do with news about Husain's or Tyeb Mehta's prices reaching a peak at the Sotheby's or a Christies' auction or the aesthetic sensibilities of the younger generation are getting more refined. I see it as a mix of both and it is indicative of art entering the mainstream although there is a long way to go. However, the scene is fast changing and a new buying class in emerging.

You too can profit from art. Compared to real estate, it is much easier to invest in, you can invest in small amounts, it is a liquid investment and gives you the same rate of returns, besides it will give you visual pleasure and pride of ownership. What more you can ask for.